Continue Education Accounting Profit and Loss Account

Profit & Loss account:

Though generally called as Profit & Loss account, it has two parts in it called

- Trading Account

- Profit and loss account

Trading account

It is generally concerned with the activities of Main business or Manufacturing activities. It is generally referred as "those items which have an effect the cost of a product or the expenses that are directly attributable to the main business are taken into Trading account"

Direct expenses are those expenses that are variable with the quantities or object or those expenses which contribute for the item of trade ready for sale and contribute for its cost.

Examples are:

Labor charges paid for the direct labor in manufacturing the goods

Cost of materials consumed in the process of manufacturing etc.

In other words these costs are the incidental costs for the entity to make the raw materials ready for sale.

Trading account shows the result of Manufacturing activities or the incidental or primary activities of an entity in the form of " Gross Profit or Gross Loss ". Gross Profit or Gross loss is generally calculated as a difference of Debit and Credit in the Trading account.

The Debits in trading account are the expenses arising due to the following activities,

- Freight charges for transporting the goods to and from a manufacturing or production facility

- Direct labor charges in the manufacturing process

- Stock carried forward from previous year called Opening stock

- Purchases of raw material

- Sales returns (Alternatively, Sales returns can also be shown as a reduction from the sales amount on the credit side)

- Carriage inwards or Carriage outwards (if incurred by the entity itself)

- Packing charges till the product is ready for sale

- Electricity charges of the factory or production house

- Duties and taxes on the incidental materials or raw materials.

The items that are debited in the trading account are the items that results for " Cost of Production ".

The Credits in the trading account are the results of the activities like,

- Sale of produced or manufactured goods,

- Purchase returns (Alternatively, Purchase returns can also be shown as a reduction from the cost of purchases on the debit side),

- Closing stock.

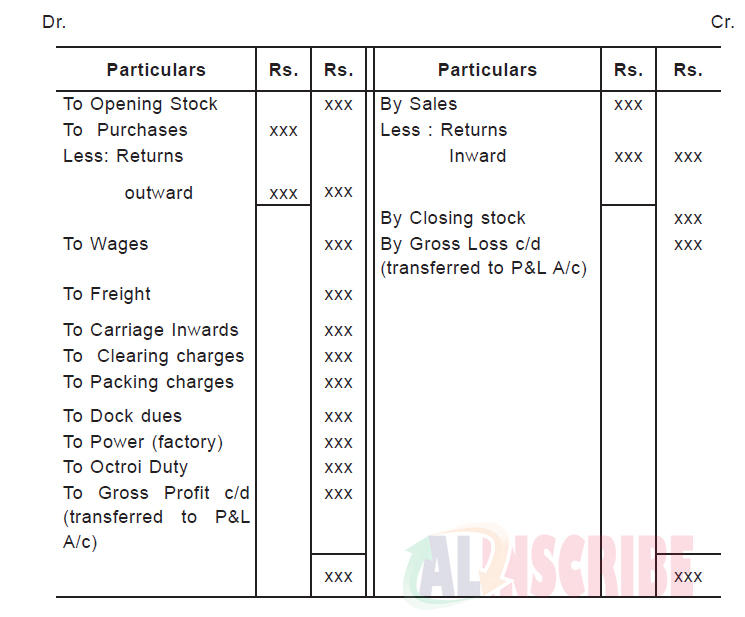

Trading Account

The difference of the total of Debit and Credit side is the Gross profit or Gross loss.

Gross profit is the situation where the Income generated by the sale of goods and value of closing stock exceeds the Cost of Production (i.e total of debits).

Gross loss is the situation where the Cost of production is higher than the income generated by sale of the goods produced.

The result of the trading account or the Gross profit or Gross loss is then carried to an account called Profit and loss account. Profit and loss account is the account which holds all the cost incurred for secondary or supporting activities. It accounts for all the costs other than those accounted for in the Trading account.

Items of Trading account debit side:

- Opening Stock:

This is the stock held by the company at the opening of the year which has been carried forward from the last year. There is no mandatory requirement that the entity should have opening stock. The maintenance of stock is the decision of the company. - Purchases:

It refers to the purchases made during the year either through cash or credit. Purchase returns are shown as deduction from the purchases and net purchases are shown. - Direct Expenses:

Expenses that are incurred for making the raw materials ready for sale like,

- Wages paid to the labor involved in the production process,

- Carriage inwards or carriage outwards,

-Duty paid like Octroi duty paid for bringing the items of production into the limits of municipality, Customs duty, clearing charges, dock dues, Import duty on the imports made

Items of Trading account Credit side:

- Sales:

This includes both the cash and credit sales made by the company. Sales returns made by the customers or buyers are shown as a reduction from the sales amount and net sales amount is reflected. - Closing Stock:

Closing stock value as referred in the trading account is the cost accumulated for making the raw materials ready for sale. This closing stock is not sold in the current year, but ready to be sold in the subsequent years and hence is regarded as an "Asset" as it has the potential to generate economic benefits into the enterprise. It is for this reason this item of closing stock is also shown as an asset in the balance sheet of the entity. - Note:

It is to be noted that the items in the debit and credit side of the Trading account mentioned above are not the only items that should be accounted for. The items can be altered based on the entity and its business or production methods.

Eg: A company which does not employ any labor force for the manufacturing of goods will not have electricity charges of factory to include it in trading account. It could get the work done through job work without manufacturing (or) a company solely included in the process of trading goods and has no manufacturing activities at all will not show any item related to manufacturing.

In some cases expenses in the trading account, if not incidental to the core business would be accounted in P&L account.

Profit & Loss Account:

Profit and loss account starts where the trading account ends. It is the account which accounts for the expenses that are incurred by an entity from the time it is ready for sale in the market like selling expenses, marketing and advertising expenses, distribution expenses etc.

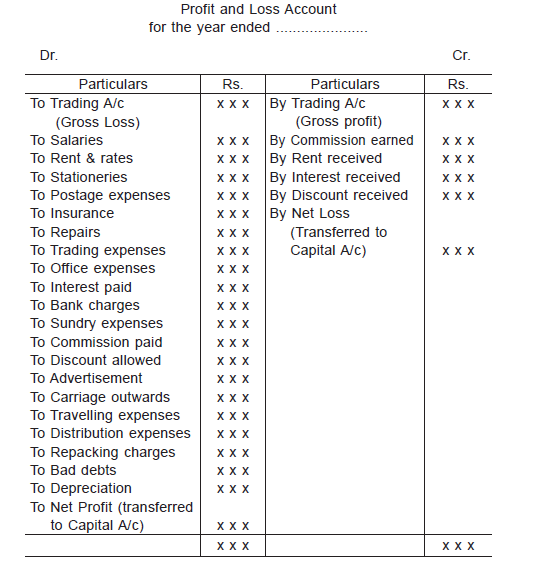

The profit and loss account for Partnership firms and Proprietary concerns is as follows.

The Gross profit or Gross loss from the trading account is carried forward to this P&L account and is netted off with the expenses and incomes in the P&L account. The P&L account in general accounts for the Indirect expenses and Indirect incomes.

Indirect expenses or Indirect incomes are the items of expense or income that are not incidental to the primary or core business of the enterprise. This does not mean that these expenses are not required to run a business. These expenses also play a greater or very important role in the growth of a business, but are not directly attributable to the cost of the goods produced or traded.

Profit & Loss account exhibits the result in the form of "Net Profit or Net Loss".

Items debit side of Profit and Loss account:

- Office and Administrative expenses:

Expenses that are incurred for the functioning of Office like salaries paid to office staff, Rent paid for office, lighting charges for office, Printing and stationery charges incurred, expenses towards telephone charges etc.

- Repairs and Maintenance:

The expenses incurred for repairs and maintenance in office that doesn't change the useful life of the any asset is regarded as "Expense of Revenue nature" and is recorded in P&L account. Any repair which has substantial effect on the nature and life of the asset is regarded as "Expense of Capital nature" and is to be adjusted to the value of assets shown in the Balance sheet.

- Interest expense or Finance charges:

Finance charges or interest expenses pertaining to the amount borrowed for the functioning of business is accounted for in the P&L account.

- Selling and distribution expenses:

Expenses like advertising expenses, campaigning expenses incurred for the promotion of goods, travelling expense, salary or commission paid to Marketing and Salesman, repacking charges as per the buyer's preference etc are accounted under this head.

- Depreciation:

Depreciation is the fall in value of asset due to the wear and tear of the assets in the business. In other terms, it is the reduction in the value of assets due to the usage of assets like Plant and machinery, Building, Furniture etc. in the manufacturing and other operations of the business. The guidelines for providing depreciation are given under the Schedule II of the Companies act, 2013. Depreciation is mandatory for every entity that has assets to enjoy benefits under various sections in the income tax act and providing depreciation is a pre-requisite for a company which is planning in distribution of dividend for its share holders.

- Bad debts:

Bad debts are a part of debtors or receivables that are proved to be unrealizable. These are the items that are no longer realizable and are to be written off. These bad debts are also reduced from the value of Debtors in the balance sheet of the entity.

- Other expenses:

Any other expense that are incurred by the business entities but are not a part of cost or trading account are accounted for in the profit and loss account.

Items of P&L Credit side:

The items of credit side are the income that arises from the business activities not incidental to the primary business like,

- Income from investments,

- Interest income on FDs, savings account etc,

- Discount earned,

- Commission received,

- Rent Received.

The result of P&L account either Net profit or Net loss is transferred to Capital account in the balance sheet. This Net profit or Net loss is the true result of operations of the entity.

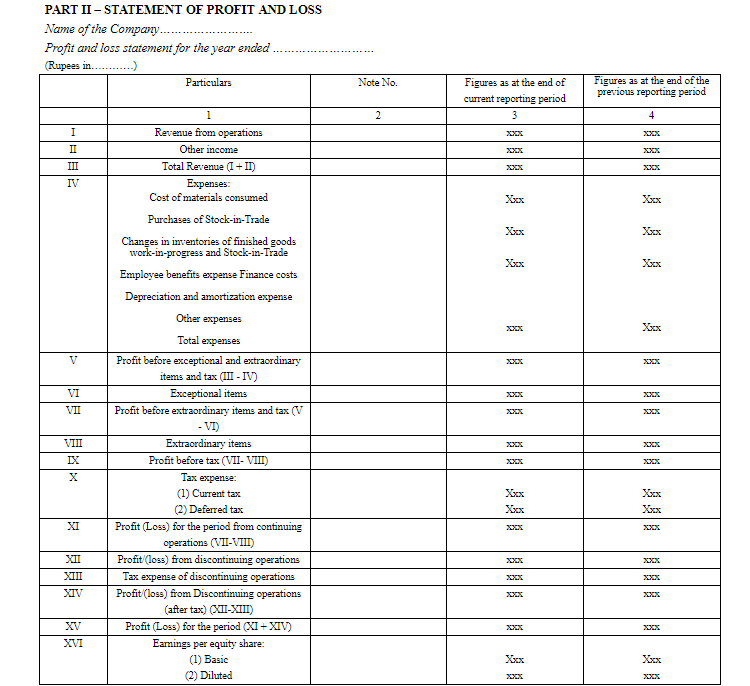

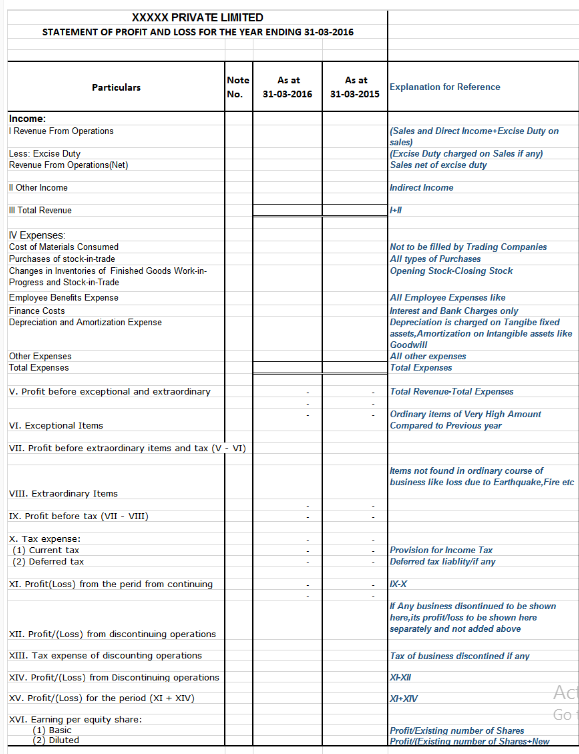

The Profit and Loss account for Public Companies and Private companies is to be prepared as per Part II of Schedule III which is as below.

The items of Statement of P&L in Part II of Schedule III is as follows

Source: https://www.alinscribe.com/articles/504/profit-and-loss-account.html

0 Response to "Continue Education Accounting Profit and Loss Account"

Post a Comment